How To Report Exercise Of Stock Options On Tax Return

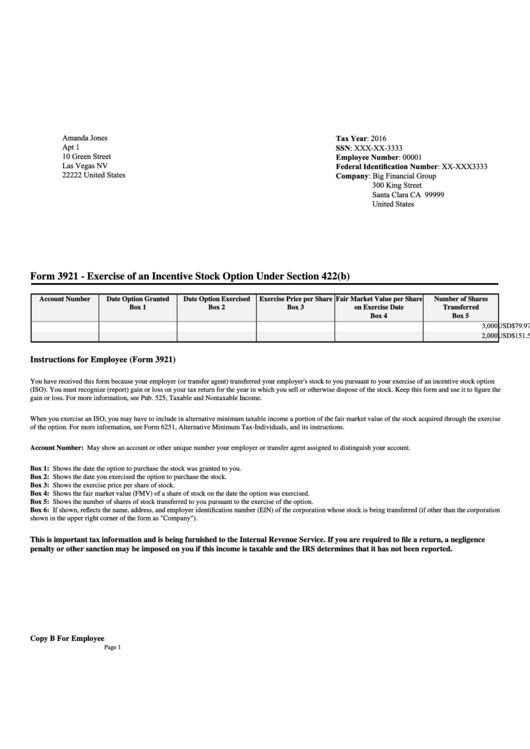

How To Report Exercise Of Stock Options On Tax Return. The form reports any capital gain or loss resulting from the transaction on your tax return. Incentive stock options (ISO) are compensation to employees in the form of stock rather than cash.

Exercising your non-qualified stock options triggers a tax.

Even though you never owned all the stock.

Stock options are employee benefits that enable them to buy the employer's stock at a discount to the stock's market price. Keep this form and use it to figure the gain or loss. This form will report important dates and values needed to determine the correct amount of capital and ordinary income (if applicable) to be reported on your return.

Rating: 100% based on 788 ratings. 5 user reviews.

Richard Carsons

Thank you for reading this blog. If you have any query or suggestion please free leave a comment below.

0 Response to "How To Report Exercise Of Stock Options On Tax Return"

Post a Comment