Income Based Repayment Chart

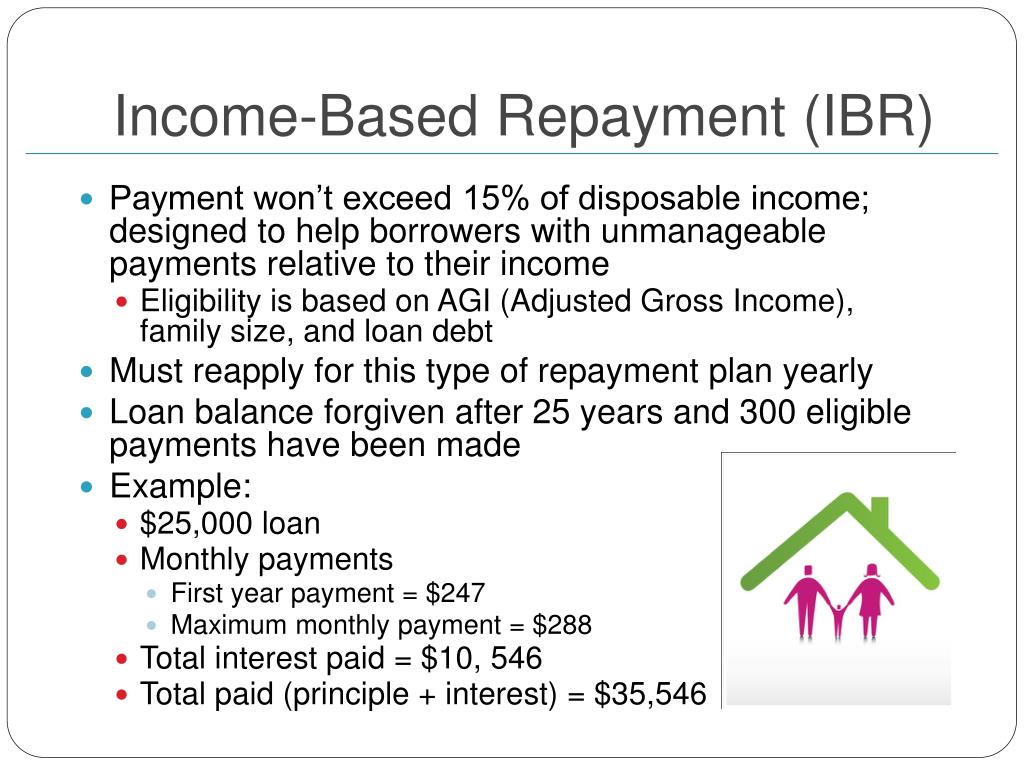

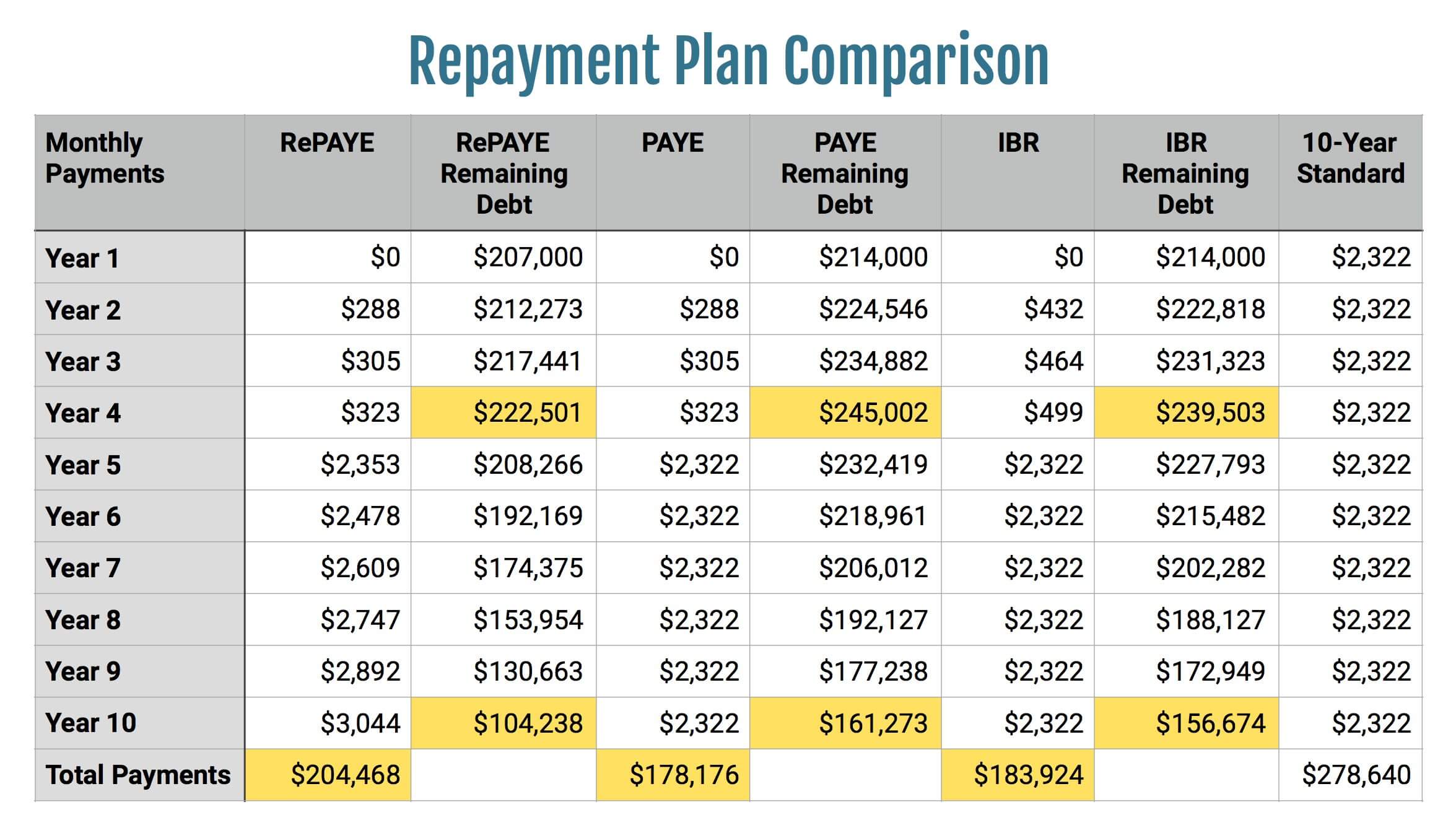

Income Based Repayment Chart. The calculations involve your income, family size and state of residence. An income-driven repayment plan sets your monthly student loan payment at an amount that is intended to be affordable based on your income and family size.

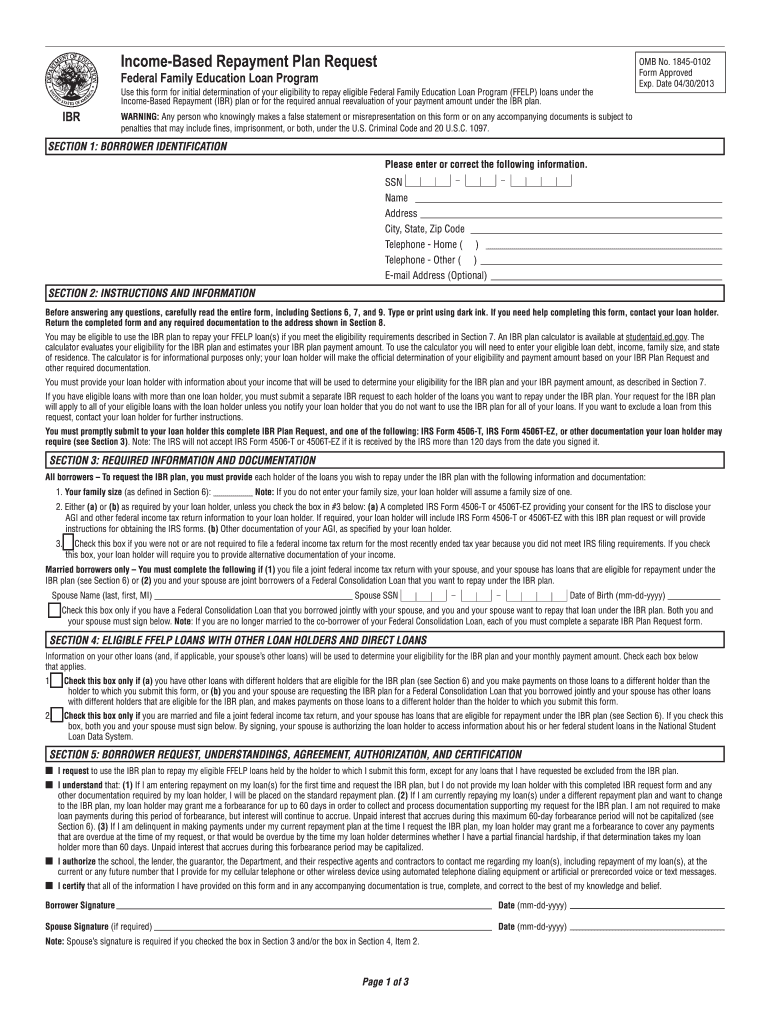

See the official "Income-Driven Repayment Plan Request" form for a comprehensive description of eligibility criteria for each of these plans.

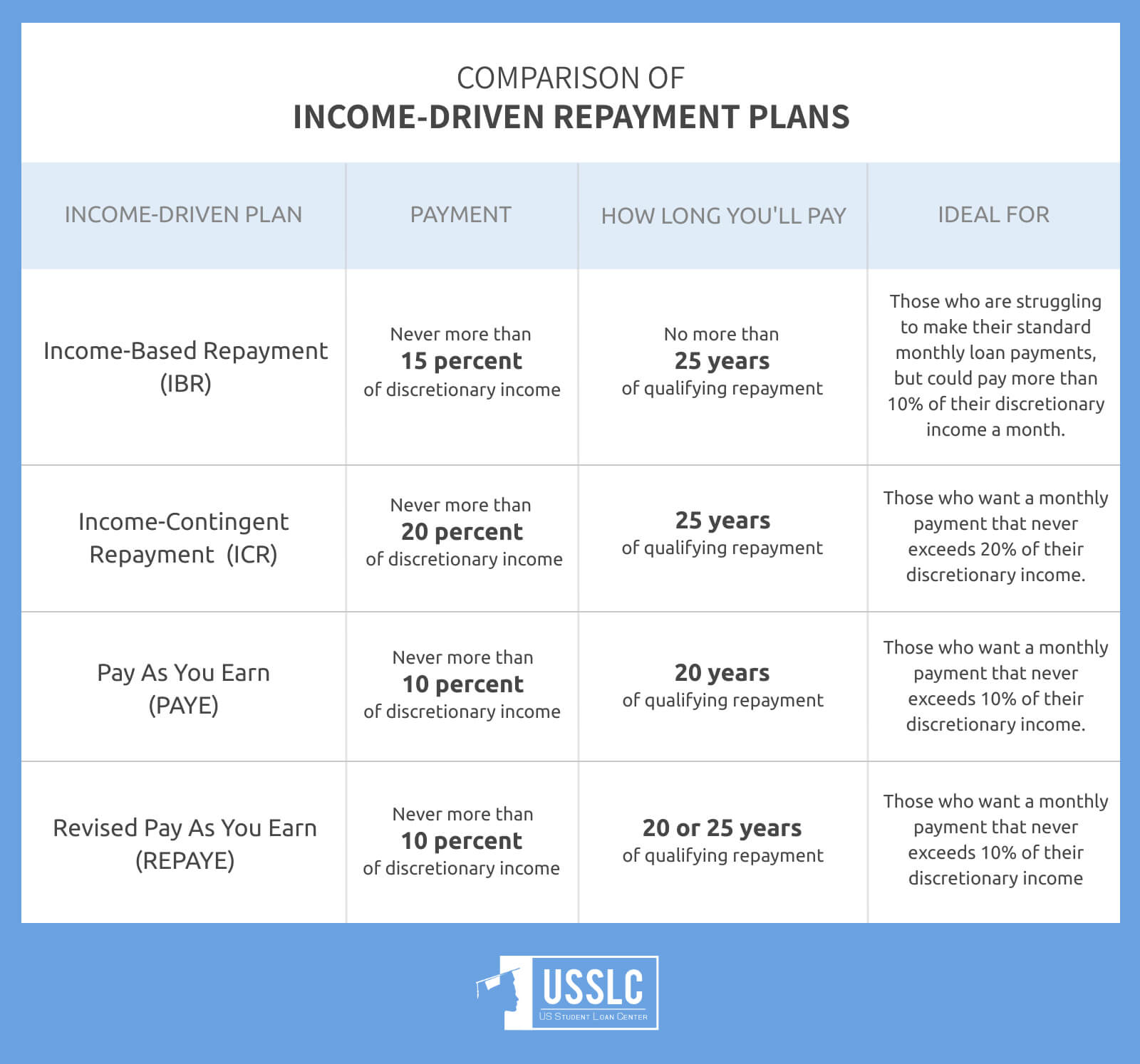

Income-based repayment is often used as a catch all phrase to describe the following federal student loan plans plans: Revised Pay As You Earn (REPAYE), Pay As You Earn (PAYE), Income Based Repayment (IBR), and Income Contingent Repayment (ICR)..

As such, the payment is based on the borrower's household adjusted gross income (AGI), household size and the poverty guideline established by the U. An income-driven repayment plan sets your monthly student loan payment at an amount that is intended to be affordable based on your income and family size. Plug in some numbers and see how much you can save under IBR.

Rating: 100% based on 788 ratings. 5 user reviews.

Richard Carsons

Thank you for reading this blog. If you have any query or suggestion please free leave a comment below.

0 Response to "Income Based Repayment Chart"

Post a Comment